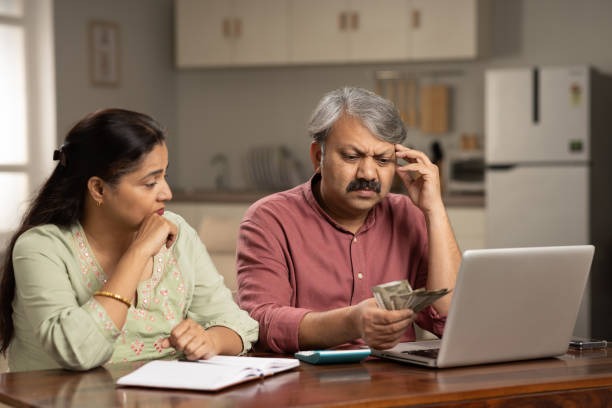

Navigating the financial landscape with bad credit can feel like an uphill battle. However, having a less-than-perfect credit score doesn’t mean you are entirely shut out from obtaining a loan. While traditional lenders may be hesitant to approve applications from individuals with poor credit histories, there are still viable options available that cater specifically to those in such situations.

Firstly, it is essential to understand what constitutes “bad credit.” Typically, a FICO score below 580 is considered poor. This could result from missed payments, defaults, or high levels of debt relative to your income. Although this can limit borrowing opportunities and lead to higher interest rates when loans are approved, it does not completely close off all avenues for securing funds.

One potential avenue loans for bad credit is seeking out lenders who specialize in subprime loans. These lenders assess more than just your credit score; they consider factors such as employment history and income stability. Subprime loans often come with higher interest rates due to the increased risk taken on by the lender but provide an opportunity for those unable to secure financing through traditional means.

Another option worth exploring is peer-to-peer lending platforms. These online services connect borrowers directly with individual investors willing to fund their loans at agreed-upon terms. This model allows for greater flexibility in evaluating applicants beyond standard criteria used by banks or other financial institutions.